Climate Finance… and Where Do We Go from Here?

An incredibly topical and important issue, and one that we debated at length at the recent COP28 summit in Dubai. It was a great pleasure to make a keynote presentation on this critical topic at the ESG Summit 2024, organised by Global Partners Investments (GPI) under the High Patronage of the Office of His Highness Sheikh Tahnoon bin Saeed bin Tahnoon al Nahyan.

We took a deep dive into the sources of climate finance currently available from MDBs, governments, and private investors, as well as some of the challenges faced. The importance of loss and damage programmes and the ongoing tensions between developed and developing economies were also discussed.

Underlying the whole conversation was the shocking fact that there is a yawning climate financing gap. The Paris Agreement's target is to keep global warming to no more than 1.5°C above preindustrial levels. The projected annual funding requirement to achieve this target is no less than $9 trillion per annum until 2030 and $10.8 trillion per annum until 2050. Global climate finance amounted to only $1.3 trillion in 2022, according to a report last year from the Climate Policy Initiative. What an (impossible) challenge to bridge this gap!

To put the whole climate finance deficit further in context, we are currently spending $2.2 trillion per year on military expenditure and, staggeringly, no less than $6.6 trillion per year on fossil fuel subsidies, according to the same report.

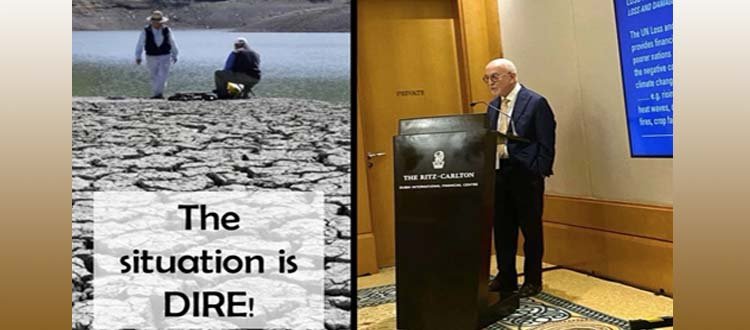

The situation is dire. The world is on the verge of a climate abyss, as stated in a recent UN report. Eighty percent of the world’s foremost climate experts expect a rise of between 2.5°C and 3.0°C above preindustrial levels by 2030 — a catastrophic level of heating, as reported in a recent Guardian survey. The battle to keep 1.5°C alive will be won or lost in the remaining years of this decade, under the watch or otherwise of our current political and industry leaders.

#esg #climatechange #esginvesting #climatefinance

View Article Source